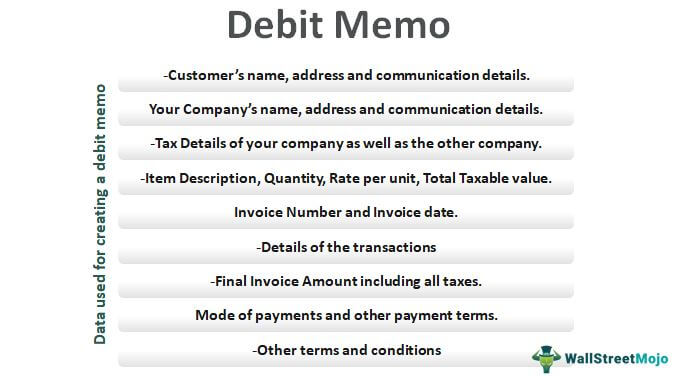

A Debit Memorandum Increases Which - This can be an alternative version of an invoice to a customer and is used when the amount billed on the original invoice was too low. It helps to increase the revenue of the business and also to correct the Invoice Value wrongly raised or shortly raised.

Presented Golden Rules Of Accounting In A Good Manner To Know More Visit Www Santhoshedu B Accounting Education Accounting Basics Financial Statement Analysis

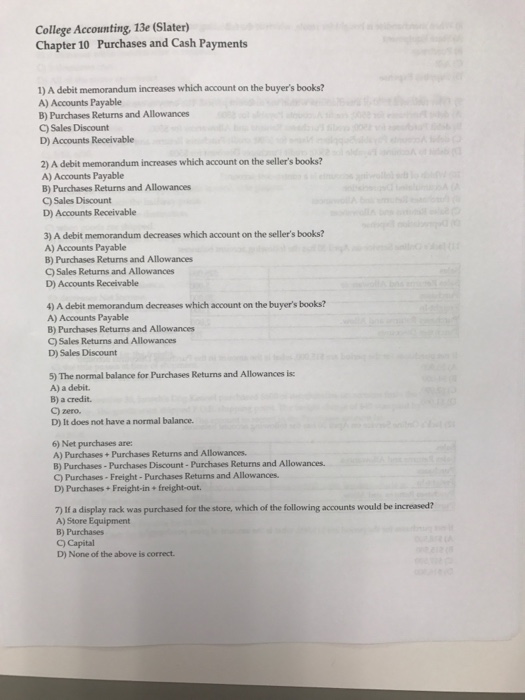

A debit memorandum increases which account on the buyers booksA.

A debit memorandum increases which. A debit memorandum increases which account on the buyers books. What is a Debit Memo. Accounts ReceivableI think it is either B or D.

A Credit Memo is a negative amount invoice you receive from a supplier representing a credit. To keep the Accounting Equation in balance the DebitCredit treatment of Liabilities and Equity is the opposite of Assets. Debit Memorandum Memo Definition.

Credit Memo and Debit memo are used to create a negative amount invoice. I want a correct answer and guaranteed Agrade in the subject So only apply if you are really an expert in this subject field. Buyer makes a purchase on credit.

For instance if ABC Co. 230 __C___ A Accounts Payable B Purchases Returns and Allowances C Sales Discount D Accounts Receivable. Steps to Create a Debit Memorandum A debit memorandum can be created by utilizing the following steps.

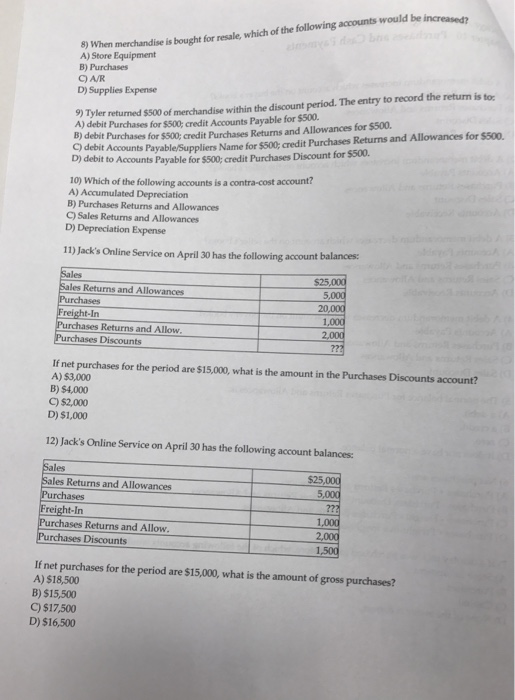

A Accounts Payable C Sales Discount D Accounts Receivable 3 A debit memorandum decreases which account on. A debit memorandum increases which account on the sellers books. A debit memorandum increases which account on the buyers books Aaccounts payable Bpurchases returns and allowances Csales discount Daccounts receivable.

A credit memorandum decreases the amount to be paid by the customer to the company whereas a debit memorandum increases the amount to be paid by the customer to the company. The banks use of the term debit memo is logical because the companys bank account is a liability in the banks general ledger. Please help me ASAP.

College Accounting 13e Slater Chapter 10 Purchases and Cash Payments A Accounts Payable C Sales Discount 2 A debit memorandum increases which account on the sellers books. They allow double-entry bookkeeping to work. Debit Memos in Incremental Billings.

230 A debit memorandum increases which account on the sellers books. The purchaser uses the debit memorandum to inform the seller about the return and to prepare a journal entry that decreases debits accounts payable and increases credits an account named purchases returns and allowances which is a contraexpense account. A debit memorandum or memo is a form or document sometimes called a debit memo invoice that informs a buyer that the.

Thus the debit memo is essentially an incremental billing. Debit Memo is a negative amount invoice you send to notify a supplier of a credi. And invoices the customer.

There are several uses of the term debit memo which involve incremental billings internal offsets and bank transactions. Debit Memorandum Memo Definition. The bank accepted the companys cash which is recorded by a debit to the banks Cash account and the bank credits its liability account Customer Deposit Accounts.

Fills an order for XYZ Inc. Seller incrementally increases an amount on a. In formal parlance it is notifying a customer that the debit memorandum will be increasing their accounts payable.

At times when businesses are required to increase the billed amount they choose to release a. A debit memorandum decreases which account on the sellers books. A Debit Memo is a document raised by the accounts to increase the value of Accounts Receivables without effecting the original Invoice Value.

Purchases Returns and AllowancesC. A seller issues a debit note debit memo or memorandum to inform a buyer of an increase in debt obligations in 3 situations. Its the opposite of a credit memorandum where the latter is used to reduce or write off an over-billed invoice.

I am confused on these 2. A transfer of funds to another account at the bank. I am in a hurry and doing an urgent quiz and assignment related to above question I need help for it.

This memo is a legal document that informs the customer of a debit adjustment made to their accounts. Debit entries decrease Liability and Equity accounts and Credit entries increase them. If a display rack were purchases for the store which of the following accounts would be increased.

Sales Returns and AllowancesD. A debit memorandum or memo is a form or document sometimes called a debit memo. These variations are explained below.

Debit and Credit rules are just a mechanism to keep the Accounting Equation in balance.

Effective Salary Increase Request Letter Sample Helloalive Salary Intended For Request For Raise Letter Template In 2021 Salary Increase Raised Letters Lettering

Debit Memorandum Definition

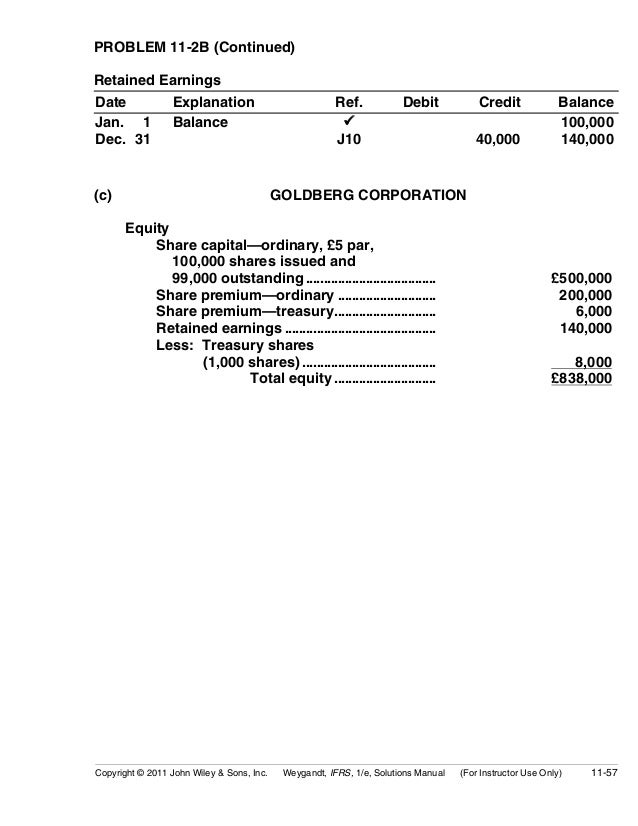

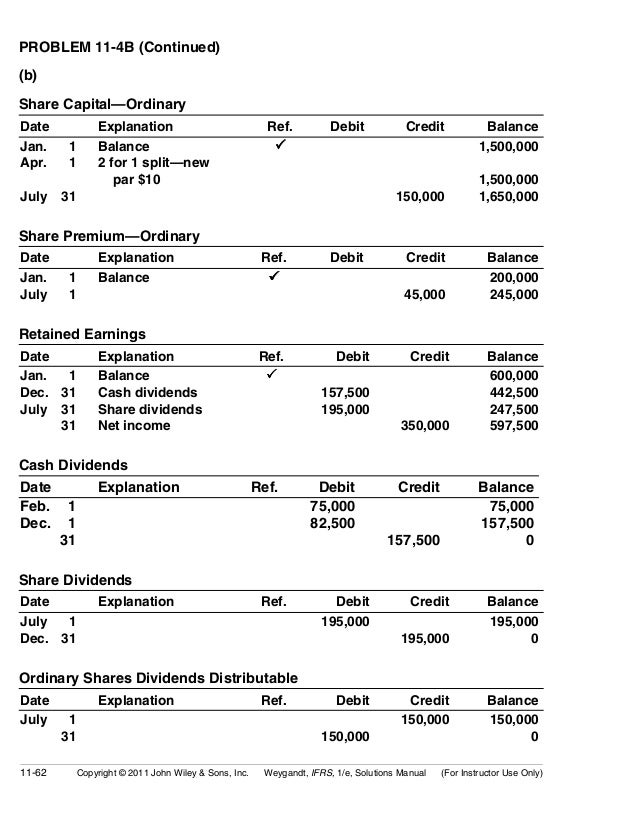

Ch11 Solution W Kieso Ifrs 1st Edi

Ch11 Solution W Kieso Ifrs 1st Edi

Debit Note Debit Memo Debit Memorandum Financetuts

Amazon Com Accounting Ledger Journal Entry Book Notebook Bookkeeping Log 9781097542024 David J Barnett Publishing Journal Entries Bookkeeping Accounting

What Is A Journal Entry Accounting Basics Journal Entries Journal Format

College Accounting 13e Slater Chapter 10 Purchases Chegg Com

Image Titled Learn Accounting On Your Own Step 1 Learn Accounting Accounting Business Books

Debit Memo Meaning Example How To Create Debit Memo

Accounting Zone Items On Company S Bank Statement Facebook

Accounts Payable Cycle Definition 12 Steps Of Accounts Payable Cycle Accounts Payable Accounting Learn Accounting

A Tutorial On Double Entry Bookkeeping And Accounting Using General Ledger Online Accounting Basics Bookkeeping Accounting And Finance

College Accounting 13e Slater Chapter 10 Purchases Chegg Com

/woman-with-paperwork-and-check-electronic-banking-at-laptop-1089096040-c48b560b2e6f439a90ea46513eaf4010.jpg)